From Sun to your Ghar – How Energy travels from a solar power plant

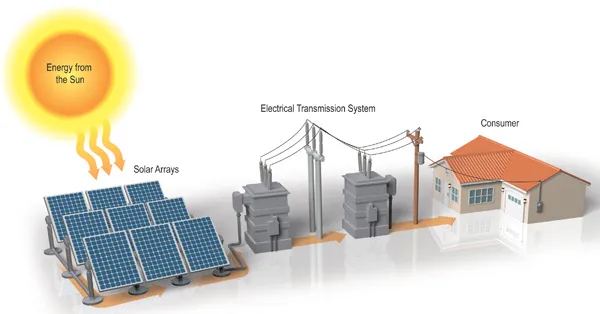

This article explains what happens with the energy generated by PV solar plants: from the solar cells to final consumers through the grid.

PV solar plants generate energy by using the photo-effect that converts sunlight into electricity. As different from home-based rooftop solar systems, they usually operate on a larger scale and for the purpose of selling the electricity generated from panels to industrial or public customers.

While one can install a rooftop solar system in one’s home and use the energy for in-house consumption, PV solar plants sell it either directly to the public utilities, or to contractor companies that sell the energy to the central grid.

Thus, the most important difference of Open Access PV solar plants is that they do not provide electricity to the direct consumers. That would require the level of flexibility that is incompatible with the scale of their operation. Instead, all energy from the solar panels goes into the grid.

This requires a transmission & distribution (T&D) system in place in some form. The remainder of this article covers several options of T&D designs, and how solar energy travels through them.

1. Varieties of energy distribution

In general, there are several options of how energy distribution can be organized in the case of solar energy generation. Essentially, this model is suitable for individuals or small businesses that operate their own small-scale solar energy facilities, like rooftop-based PV solar systems. In this model, the direct producers consume solar energy generated in-house, and sell the excess to the grid or exchange for tradeable commodities.

2. Market-based energy distribution: Renewable energy certificates

Formerly, some other schemes have been used to distribute the energy from PV solar plants. For example, in the early stages of the industry development, PV solar energy producers used to exchange energy for green certificates that were then sold to legal entities (companies and organizations).

The term itself originated in Europe, where it is still predominantly used, but it is also gradually becoming established in the world at large. As such, a green certificate is a tradeable commodity that proves that certain amount of electrical energy is generated from renewable energy sources, like solar energy, often further divided into PV and solar thermal. Usually, one such certificate equals 1 MWh of electricity and thus also represents the environmental value of renewable electricity generated. Green certificates can also be sometimes called renewable energy certificates (RECs). The meaning is the same: they are essentially tools for trading among consumers and/or producers of renewable energy and enable purchases of voluntary green energy.

The utility of such certificates is that they can be traded independently of the energy produced, so as to support the renewable electricity production by means of the market mechanism. National trading schemes using green certificates are in place in such countries as Poland, Sweden, the UK, Italy, Belgium, as well as some of the USA states.

Basically, green certificates are claims that the owner consumed a portion of the whole energy in the grid that was generated renewably. That means that the green certificates can circulate within the economy, but do not affect the production of renewable energy directly: only the way how it is distributed among the economic agents. Another limitation of green certificates is that their sphere of circulation is usually limited by the borders of nation-states, so that a US-based certificate cannot be exchanged or traded for another one, issued by some other country.

Net metering stands in between the two models, since it allows using renewable energy anytime, and not only immediately after it has been generated, and applies to both retail and direct producers.

3. Non-market energy distribution: FiTs and PPAs

Besides direct production / in-house consumption (prosumer model), and distribution via the market mechanism (with the help of certificates), energy can be transmitted to the clients by means of non-market distribution systems. This is the case of PV solar plants that sell energy to the grid or intermediary companies that operate the grid before it reaches the direct consumers.

The income of a solar plant derives from the sales of electricity to the grid, and its output is metered in real-time on a half-hourly basis (or similar period) in order to balance the settlement in the market for electricity.

Here the most important support mechanism is Feed-in-Tariff (FiT) and Power Purchase Agreement (PPA). These mechanisms are provided by the government of the country in which the solar plant is located, and as such they can be labeled as non-market energy distribution. This label reflects the fact that FiTs and PPAs do not operate by means of artificial commodities like green certificates.

Feed-in-Tariffs guarantee renewable energy generators certain specified payments settled over a fixed period of time, per unit of energy generated (kWh). The payment may be structured as a guaranteed minimum price or as a premium paid on top of the wholesale electricity price (feed-in premium). The level of compensation is normally above the retail price, although as the number of renewable generators increases, it can tend down to the retail price.

PPAs are contracts between the seller, or renewable generator, and the buyer who purchases electricity. PPAs define the commercial terms of sale, e.g. when the project will begin commercial operation, the delivery schedules and penalties for delays, terms of payment and contract termination. This is why the PPA is usually signed before the actual construction of the PV solar plant.

PPAs pay for the generation of electricity from renewable sources, usually below the retail rate, but higher in the case of solar energy, because it is often used in times of peaking demand. PPAs are extremely important, because they define the revenue and credit quality of renewable energy generating projects, and thus are essential financial instrument for their implementation.

Both instruments are applicable to any renewable energy generators, including home-based, but are best suitable for industrial generators like PV solar plants that have a larger scale of operation. Moreover, since both usually are fixed for a long-term (15 to 25 years), they ensure the return on investment for the funders of PV solar plant projects.

4. How Energy Travels

In other words, the energy generated from PV solar plants does not go immediately to the direct consumers. Instead, it is sold to the grid operators under conditions specified in PPAs and at the rate defined in FiTs. This system ensures stability for the project developers and investors, who have the possibility to operate in a long-term perspective and yield a reasonable return on their investment.

Solar DAO addresses another problem that cannot be solved by state- nor by market-based energy distribution mechanisms by removing the capital barriers that prevent modest capitals from participating in the ongoing solar revolution. With blockchain at hand, anyone can become an investor in PV solar plants around the world and benefit from the opportunities of FiTs and PPAs.

References:

Open source internet and medium.com